The same group that turned mortgage-backed securities from Grade F failures to Grade A eventual economy destroyers is now downgrading US debt.

Now, I realize all this economic stuff can all blur together in a stream of boring languages, but this is a good example to show off how much of a joke the whole thing is. There are three groups that rate credit in this country: Standard & Poor’s (S&P), Moody’s Investor Service, and Fitch Ratings. They are pretty much all scummy, for reason which we won’t get into right now. S&P is the one we’re looking at today.

The S&P lowered its outlook on U.S. debt.

S&P changed its outlook on the United States from “stable” to “negative” and said the federal government could lose its AAA rating if officials fail to bring spending in line with revenues.

Keep in mind it didn’t change the rating, it just warned things might change.

Notable douchebag Eric Cantor is trying to use this as an excuse to hold the debt ceiling vote hostage so he can get a gold plated douchebag holder or whatever it is he wants. but, as Eric Cantor is a Republican, he’s functionally moronic and the news story he sent out mentions the last time the S&P downgraded their outlook on US debt was 1996…out of fear that the GOP would block a debt ceiling vote! Someone break out the iron…

Krugman says this is no big deal

Barry Ritholtz says the S&P are a bunch of wankers

To which I say “Who Cares?”

Its not that I disagree with their assessment — I do not — but I pay it little heed. It was much more important to me as an investor that PIMCO’s Bill Gross was out of Treasuries a month ago (and indeed, is short) than what S&P says. That was all any bond investor needed to know — no ratings agency necessary.

If ever there was an organization more corrupt, incompetent, and less capable of issuing an intelligent analysis on debt than S&P, I am unaware of them. Why do I write this? A huge part of the reason the US is in its awful financial position is due to the fine work of S&P.

Consider what Nobel Laurelate Joseph Stiglitz, economics professor at Columbia University in New York observed:

“I view the ratings agencies as one of the key culprits. They were the party that performed that alchemy that converted the securities from F-rated to A-rated. The banks could not have done what they did without the complicity of the ratings agencies.”

Hence, the “negative outlook” of US debt has come about because the inability of Standard & Poor’s to have performed their jobs rating mortgage backed securities. Ultimately, this enabled the entire crisis, financial collapse, enormous budget deficit and now political over the debt ceiling.

Of course there is a negative future outlook. Its in large part the work product of S&P and Moody’s.

Why we even have Nationally Recognized Statistical Rating Organization (NRSRO) any longer following their payola =driven corruption, their gross incompetency and their inability to discharge their basic duties is beyond my understanding.

Even with new laws, the ratings agencies escape any form or regulation or persecution for their crimes, past and future:

When Dodd-Frank became law last July, it required that ratings agencies assigning grades to asset-backed securities be subject to expert liability from that moment on. This opened the agencies to lawsuits from investors, a policing mechanism that law firms and accountants have contended with for years. The agencies responded by refusing to allow their ratings to be disclosed in asset-backed securities deals. As a result, the market for these instruments froze on July 22.

The S.E.C. quickly issued a “no action” letter, indicating that it would not bring enforcement actions against issuers that did not disclose ratings in prospectuses. This removed the expert-liability threat for the ratings agencies, and the market began operating again.

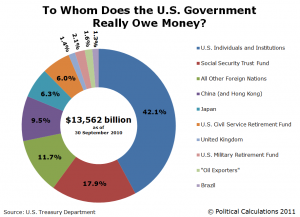

As for the debt ceiling, ever wonder just who we owe this debt to? Ourselves, mostly:

Any talk you hear of China owning the US is just xenophobic scaremongering.

Well done, Tars! Very well done! On your last sentence, I’m inclined to believe that originates from the Lyndon LaRouche crowd along with other stuff.

Pingback: Investment freedoms | Politisink